28.2.2020. The Volkswagen Group successfully completed the fiscal year 2019. 252,6 billion euros to 16.8 billion euros, sales revenues increased by 19,3 before special items, while the result of the study, 2007 (17 billion euros) rose to

Euro. The return on sales before Special Items operating on the corridor forecast 2019 target 7,6 (7,3) percent. 15.4 operating profit (previous year: 13.9) billion euros, rose.

2.3 the adverse effects of diesel (3.2 billion euros) decreased. The automotive division significantly in euro 10.8 net cash flow net liquidity (-5 m). thus, Ukraine (19,4) billion euros, has risen to be improved. The board of directors and the supervisory board (4,80 euros) per preferred share for for 6.57 6.50 (4,86) propose increasing the dividend per share of euro stock. Dividend payout ratio of 24.5 per cent (20,4) will increase.

In 2019, attractive in declining markets and successfully expanded our product portfolio with the location we have to convince a lot of customers, ” said Frank Twitter, CEO and finance: “. The group’s turnover and operating result and net cash flow and net liquidity in the automotive division, we have developed more robust in terms of funding. The whole company is very ambitious in achieving our goals for this year, the challenging market conditions, we will continue to see a showdown.“

(+1.3 percent) at 10.97 million vehicles by 2019, a slight increase of deliveries to customers was to drive a positive operating business development. Because of the development of the Pacific Sunday increases in North America and Asia decreased slightly sped up, particularly in Europe and South America have been recorded. The group achieved in almost all regions, the share increases to Sunday.

While exchange rates showed the opposite effect, due to higher sales volume, especially income, in the case of due to improvements in the mix, such as financial services has had a positive impact on good performance. Increased at a rate of 18.4 17.3 billion euros pre-tax result before tax return on sales was 7.3 (11), rose to EUR at a rate of. In spite of the challenges in the Chinese market in China, joint ventures the share of operating profit of nearly 4.4 billion at the previous year’s level (4.6) Euro could be held.

10.8 billion euros in the automotive division net cash flow of the previous year and rose to the lowest value. Especially with high gain, diesel, lower stock and a small cash out to do-he had his reasons.

Net liquidity in the automotive division decreased compared to the end of 2018, Leases (billion positive, Ukraine (19,4) Euro account) – despite the negative impact of IFRS 16. Research (R & D intensity) and the ratio of development costs (%6.8) 6.7 has been actually slightly below the previous year’s level. The financial investment rate (per cent 6,6) 6,6 has changed.

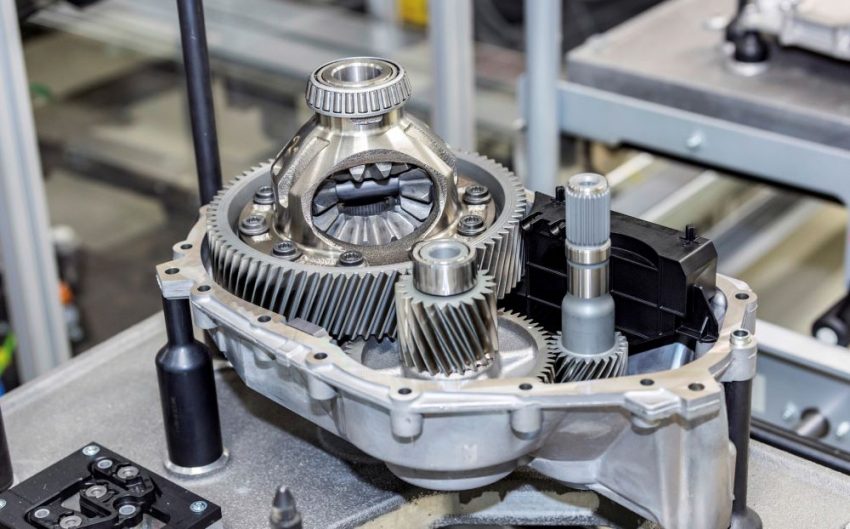

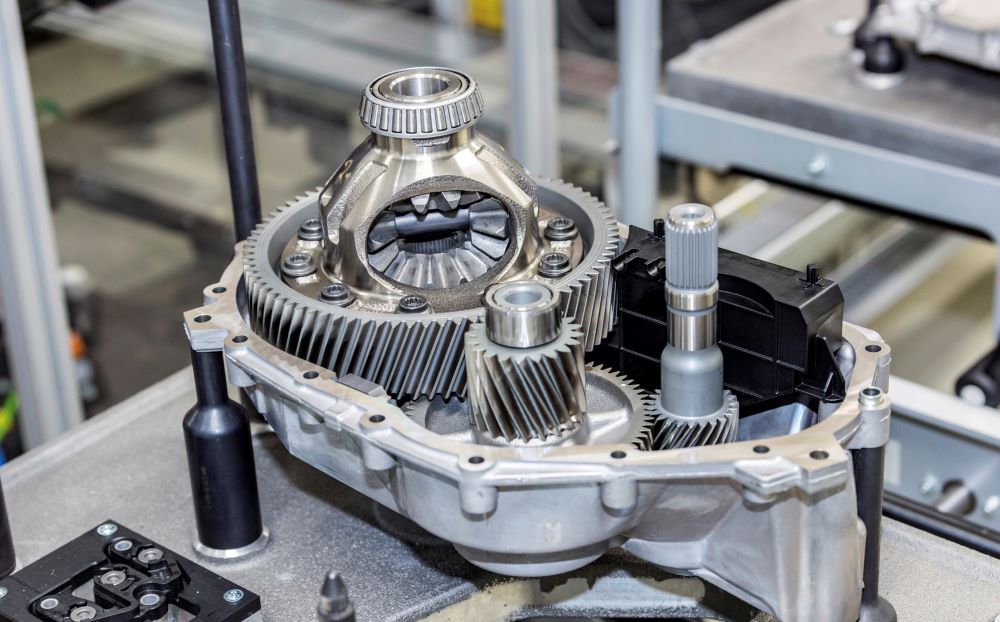

E-APP310 the drive unit (PHOTO: Volkswagen AG)